Politics for Joe:

October 10, 2011

By: Hubert O’Hearn

As always, I refrain from writing about politics until I actually have something to say that will be informative and if we’re both lucky, entertaining. For that reason I had no worthwhile comments to make on the provincial election just passed in Ontario. Early on I perceived it as mediocrities in a quest for complacency and nothing happened to shake me from that opinion. Enough said.

Now what is interesting is the whole Occupy Your City movement that is generating and spreading from the Occupy Wall Street demonstration that began in New York on September 17th. That is a topic a man can sink his teeth into. As the major media coverage has been sketchy and patronizing at best, it will be worth both our whiles to look deeper into the phenomenon with the ultimate question considered: What’s in it for You?

PART ONE: What’s It All About?

Background - The Bailout

First, a bit of background. In 2008/2009 the biggest financial institutions on Wall Street were in crisis: Goldman Sachs, Bank of America, the insurer AIG among them. We’ll use the catch-all term Banks for ease of description. Because of the dubious mortgage and hedge fund practices invented by the Banks, consumer lending in the U.S. was drying up, foreclosures were accelerating, and the conclusion reached was that the U.S. Government needed to bail out the Banks. Primarily through loans from the Federal Reserve, the U.S. and its taxpayers are currently on the hook for $4.6 trillion.

That’s four point six trillion dollars. Trillion. When Steve Jobs died last week his estimated fortune was worth $7 billion. The bailout has added up to Steve Jobs times 6500.

The entire Canadian federal Government is estimated to spend $270 billion this year - on everything. The bailout has added up to Canada times 16.

Barack Obama’s proposed budget for 2011 that indirectly led to the stand-off over spending limits in September was $3.6 trillion. (all figures from the Congressional Budget Office) The bailout is bigger than the combined cost of the wars in Iraq and Afghanistan, Medicare, Medicaid, repairs to roads, schools and bridges, agriculture subsidies, NASA, national parks etc. combined. the bailout is bigger than that.

The projected U.S. deficit for 2011 is estimated to come in at $1.8 trillion. The bailout package is 2.5 times bigger than that deficit.

I could go on, but I think you get the point. This was a bloody big bailout.

Ultimately, the bailout was a strategy. Here is a problem, let’s try something. Massive spending can work. It has won a couple of World Wars,and more scam.e peacefully paid for the Louisiana and Alaska Purchases. All those things have worked out pretty well, particularly since Sarah Palin chose to not clog the airwaves by running for President. So did the Bank bailout do what it was intended to do? Did it free up consumer credit? Did it improve the overall economic situation?

The Trail of the Money

Well, not to be judgmental or anything, but the answer has to be No. Following the trail of the money is like following the cards in a street corner Three Card Monte scam. How the U.S. got to $4.6 trillion is fascinating to observe. Initially, during the final months of the Bush administration, there was a total of $700 billion in low-interest loans to the Banks with no timeline for repayment. That was the start.

I’ll be describing to you what ‘toxic assets’ are in a moment, but for now, let’s just say that those were the money-losing assets on the books of the Banks that were eating up credit and putting the Banks in crisis. Under the Troubled Asset Relief Program (TARP) of 2008, the U.S. Government took these assets in return for the $700 billion. But what does the Federal government do with a bunch of foreclosed mortgages?

Why, it sells them back to the Banks and the families of their executives! According to the research done by Matt Taibbi of Rolling Stone, the wives of two Morgan Stanley executives were given a $220 million loan by the Federal Reserve Bank (the Fed) to buy assets that the Fed had taken from Morgan Stanley in return for its share of the bailout.

If this is arm’s length, the arms are the length of a centipede’s legs. The Fed essentially said, ‘We’ll give you money to replace the stuff that’s dragging you down and once we fix it we’ll give you money to take it back, and you won’t have to pay any of that back until you, you know, want to.’

That’s just one example. Many, many others get the bailout up to $4.6 trillion. Money chasing money.

What’s a Toxic Asset?

There were several reasons for the Great Depression of the 1930s. One of the truly crucial ones was the action of the Banks in confusing Investment and Commercial lending. What’s the difference?

Commercial lending is what you probably think of when you think of a Bank. You want to buy something that someone else has - let’s say a car. Dealer has car, you want car, you need money to give to car dealer. You go to bank. Bank lends you money to give to dealer. The asset of the car is security for the loan, as is the interest rate set at a level to pay for the bank building and salaries, plus the risk of you smashing up the car and not re-paying the loan. That is commercial lending made simple.

Investment lending is when a Bank like Morgan Stanley or Goldman Sachs underwrites a financial instrument and sells it to the public. I sense this is making your head hurt. Let me make that as simple as the commercial lending example.

You’re the car dealer. You want to expand your business which means you need LOTS of money. So you decide to offer shares in your dealership. You haven’t got a clue how to do that, so you turn to the Investment Bank. The Bank says, ‘Groovy, we think your company - about to become a corporation - is worth $1 million. We’ll give you the $1 million, chop the business up inti shares and sell them to the public. You have your million. You can expand. If the public pays more than that million when we put the stuff on sale (the Initial Public Offering or IPO), we make money. Everybody’s happy!’

All well and good, until the Commercial end and the Investment end start having sex with one another. (Yes, this is the hot part. Boom chicka wow wow) In the example of the car dealer wanting to expand, besides the Bank and the buyer/shareholder you have a third party - the car dealer. Remember what the role of the Bank is:

It assesses the value of the business

It underwrites and sells based on that value

Now, you’re a good and honest person. But if you’re selling anything from yard sale junk up to your summer home, are you going to offer it for the lowest price you think you might get or somewhere up around the high end? Don’t answer that, you don’t need to. The guy wandering up to your yard sale folding table and looking at that old ‘More Than a Feeling’ LP by Boston is thinking, ‘That’s worth $2.’ You have it marked for $5 - he walks away. The potential buyer has a sense of the value of scratchy old records. The buyer has some experiential knowledge of the value of the item being sold.

But what if you, the buyer, doesn’t know that value? Then you need an expert you trust to tell you what that value is.

Helloooooo sucker.

When the Banks, in the 1920s, started to make their own securities in the form of bonds and sold them to the public the cards really started to fly in that Three Card Monte game. Here’s a short play:

Mr. Gullible: I’d like to buy something that will make me money.

Mr. Commercial Bank: I’ll sell you this bond.

Mr. Gullible: Why should I buy that bond?

Mr. Commercial Bank: Because it’s worth a lot of money.

Mr. Gullible: Who says?

Mr. Commercial Bank: (puts on a hat saying Investment Bank) I do.

Mr. Gullible: But you’re Mr. Commercial Bank who’s selling me this.

Mr. Commercial, er, Investment Bank: No I’m not! I’m my twin brother and I am entirely objective!

Mr. Gullible: You don’t sell dead parrots by any chance do you?

Sorry for the punchline but as I’ve often said, the funnier you get the more people take you seriously.

The true metaphor is that of Fox in charge of the Chicken Coop; and I might add that a close reading of George Orwell’s Animal Farm would be beneficial in understanding the current situation. Granted, Orwell was specifically writing about the Soviet Union, but the parallel with an elite seizing power for its own uses under the guise of freedom will keep you up at night. Perhaps it is best read with a hot mug of Ovaltine at hand.

One can ignore the niceties of the Investment Bank being ‘technically’ separated from the Commercial Bank within the same financial institution. In actuality the left hand actually does know what the right hand is doing. So here are the three cards of that Monte game I’ve alluded to:

Card One: The Commercial Bank makes a loan in the form of a mortgage to a home buyer. A home realistically priced at $300,000 in terms of neighbourhood comparables is mortgaged for $400,000. The home buyer is told that the market will go up! up! up!, the rate of interest is set initially low, and as the Bank tells the buyer he can afford the mortgage, then why not? A bit of extra cash is a nice thing to have after all, so sign here.

Card Two: The Investment Bank then takes that $400,000 loan off the books of the Commercial Bank (remember, these are but two arms of the same body) and turns it and a wheelbarrow full of other loans into what are called derivatives. These are shares, for want of a better word, that can be bought and sold like stocks and bonds. But each derivative is not composed of each individual mortgage. Rather, 100, or 1000, or 10000 mortgages are sliced up and divided and stirred like muffin mix into trays of derivatives.

Card Three: A citizen looking for a retirement investment then goes to the Commercial Bank and asks for advice. The Commercial Bank says, ‘Buy this derivative!’ If the citizen happens to ask what the derivative is worth and what its growth potential is, the Commercial Bank shows that citizen the approved and researched numbers compiled by...the Investment Bank. Sign here.

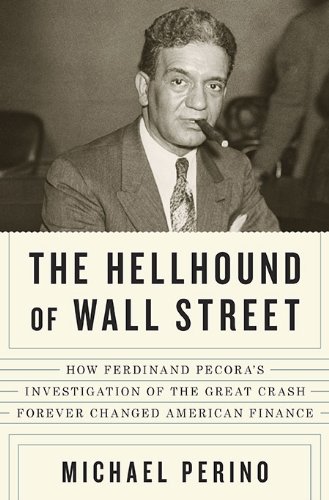

A quote for you, from a book called The Hellhound of Wall Street by Michael Perino:

'Pecora asked Mitchell about the management fund – the bonus pool at the bank – and what it was designed to do. Mitchell was more than happy to explain; indeed, he seemed eager to demonstrate how clever he had been to devise it. The securities affiliate wasn't really a commercial bank, he informed Pecora, it was an investment bank and it “selected its executives men who would normally be of the type to hold partnerships in private banking and investment companies.” Those private partnerships were “extremely lucrative,” and for City Bank to compete with them it had to offer the executives of its affiliate “some share in the profits that they should make.”'

That was in 1933, and the testimony quoted was from the waning days of a lame-duck, Republican dominated Senate Committee investigating the widespread collapse of the U.S. Banking system. The ‘Mitchell’ referred to above was Charles Mitchell, then the Chairman of what we know today as Citibank. Pecora was Ferdinand Pecora, a tough little Italian prosecutor hired by the Senate Banking Committee - again, these were Republicans in the majority - who in ten days of hearings not only exposed the Three Card Monte banking, but caused Mitchell to resign and various other Banking executives to go trotting off to prison. The securities that the Banks had created and sold to a gullible public were rotten; the executives had taken a princely cut off the top, and even under the fairly primitive regulations of that time, the whole deal was as illegal as holding up a liquor store. Those regulations were quickly tightened up as part of the New Deal under Franklin Roosevelt with Investment Banking to be kept separate from Commercial Banking.

And so matters stayed in balance and stability until the Reagan and Clinton Administrations started to deregulate. The names of the economic advisers might be familiar to you: Alan Greenspan (former head of the Federal Reserve which cut those juicy loan cheques), Robert Rubin, Lawrence Summers, and Timothy Geitner. The latter three were the guts of Barack Obama’s first economic team. The saints and sinners do not divide along party lines.

Which is why hundreds and thousands of people are camping in a park adjacent to Wall Street. They don’t trust politics any more. They don’t trust Banks any more. They want what they once had - a New Deal.

This is as good a place to sign off on Part One as any. In Part Two we will look at the actual economic situation today and at the reforms being proposed by the Occupy Your City forces.

Be seeing you.

Tidak ada komentar:

Posting Komentar